Section A. Manufactured Homes – General Information

Section B. Titling And Registering a New Manufactured Home

Section C. Titling And Registering a Used Manufactured Home

Section D. Deactivation of Title for a Manufactured Home

Section E. Reactivation of Title for a Manufactured Home

Section F. Used Manufactured Home Never Previously Titled

Section G. Manufactured Home Address Abbreviations

Section A. Manufactured Homes – General Information

Revised December 1, 2017

Definition (§66-1-4.11(B))

A manufactured home is a movable or portable housing structure that exceeds either a width of eight feet or a length of 40 feet, constructed to be towed on its own chassis and designed to be installed with or without a permanent foundation for human occupancy.

A manufactured home may also be called a “house trailer” or a “mobile home.” It is not to be confused with a “motor home.”

Manufactured Home as Vehicle (§§ 66-3-1(A)) and 66-3-19(F))

A manufactured home may be thought of as a house that, while it is temporarily on wheels between one permanent location and another, is also a vehicle and is considered to be personal property for tax purposes.

Every manufactured home, when driven or moved upon a highway, is subject to the registration and certificate of title provisions of the Motor Vehicle Code.

It is unlawful to operate, transport or cause to be transported upon any highways in this state or to maintain in any place in this state a manufactured home subject to registration under the provisions of the Motor Vehicle Code without having paid the registration fee or without having secured and constantly displayed the registration plate required by the Motor Vehicle Code.

Manufactured Home as Real Property

When a manufactured home is placed on a permanent foundation and the tongue and axles have been removed, its title should be deactivated and it should be entered on the books of the county as real property, subject to real estate taxes instead of personal property taxes. It is no longer a vehicle.?

Problems with Titling of Manufactured Homes

- A manufactured home, when it is bought from a dealer, should be titled and registered as a vehicle before it is moved on the highways of New Mexico to its permanent location.

- When the home has been placed on a permanent foundation with its tongue and axles removed, the county assessor should be notified and, once the title is deactivated, should then assess the home (together with the land on which it sits) as real property.

- If the home is later sold and it needs to be taken off the foundation, with its tongue and axles put back on for movement on the highway to a new location, it should be re-assessed as personal property and the title should be reactivated.

That is the correct process, and is the usual process today. Historically, though, many manufactured homes were never properly titled and registered when they were new. And, if the manufactured home was never titled as a vehicle when it was new, it cannot simply be reactivated now.

In that case a new title must be created, requiring all of the usual new-title paperwork, which in many cases cannot be found. In these cases, follow the procedure described in Section F of this chapter. If complete documentation cannot be produced, a surety bond process may be required.

Section B. Titling And Registering a New Manufactured Home

Revised November 30, 2017

Requirements for Titling and Registering a New Manufactured Home

- Manufacturer’s Certificate Of Origin (MCO)

The MCO or MSO (Manufacturer’s Statement of Origin) is the primary document when transferring ownership of a new manufactured home. - Dealer’s Invoice

- Lien Holder Information (as needed).

- Title Clearance Request

Manufactured homes purchased out-of-state require the Title Clearance Request for a Manufactured Home Purchased Outside New Mexico (Form ACD-31093). Clearance from the Taxation & Revenue Department is required, to confirm that any compensating tax that may be due has been paid to the State of New Mexico. - “Application for Vehicle Title and Registration”

When processing a manufactured home transaction, in addition to all of the usual information entered on the title application, you must also include the size of the manufactured home (width and length). Also include the county in which the manufactured home will be situated and the approximate location where the manufactured home will be located within the county.

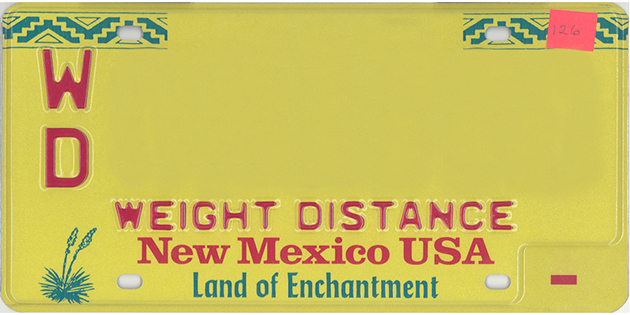

“M/HA” Plate Issued

One manufactured home plate is issued for each manufactured home. We no longer issue additional plates for double-wide and triple-wide manufactured homes. The registration is permanent and the manufactured home plate remains affixed to the manufactured home for the life of the unit or until it is sold or transferred to another owner.

Manufactured Homes Taxed as Property

After the initial registration of a manufactured home with the Motor Vehicle Division, the County Assessor in the county where it is located taxes it. Advise the customer(s) to file the manufactured home with the County Assessor.

No Excise Tax

The excise tax is not applicable to manufactured homes purchased from a New Mexico registered dealer.

Instead New Mexico dealers are required to pay a gross receipts tax (GRT) directly to the New Mexico Taxation and Revenue Department on all manufactured home sales transacted in the state. For individual-to-individual transactions, the gross receipts tax is not applicable.

Other Manufactured Home Situations

- In order to obtain a duplicate title or to add or delete a name on a manufactured home title, the “Manufactured Home Tax Status Certification” form (MVD-10063) (or a Tax Certification form provided by the County Treasurer or Assessor) is required.

- Lien Filings Are Assessed $5.00 ($3.00 Transaction fee, $2.00 Administrative fee).

- A manufactured home that came from a “sovereign nation” needs a tax release. The County Treasurer will issue a “Mobile Home Tax Status Certification.”

Section C. Titling And Registering a Used Manufactured Home

Revised November 30, 2017

Requirements for Titling and Registering a Used Manufactured Home

- Original Certificate of Title

The current outstanding Certificate of Title is the primary document when transferring ownership of a used manufactured home. - Reassignment of title completed by dealer (for purchases made from dealers)

- Completed Assignment of Title or Bill of Sale (MVD-10009) (must include sales price)

- Dealer’s Invoice (as needed)?

- Release of Lien (as needed)

- Notification of No Tax Liability

Applicants for title and registration of a manufactured home previously titled in New Mexico or any other state (including applicants for a Duplicate Title) must provide a Manufactured Home Tax Status Certification form (MVD-10063) (or a Tax Certification form provided by the County Treasurer or Assessor) showing no tax liability, completed within the calendar year, and signed and sealed by the County Treasurer or Assessor (or agent or employee) of the New Mexico county where the manufactured home was or will be located. Tax receipts will not be acceptable in lieu of this official notification of no tax liability.? - Title Clearance Request

Manufactured homes purchased out-of-state require the Title Clearance Request for a Manufactured Home Purchased Outside New Mexico (Form ACD-31093). Clearance from the Taxation & Revenue Department is required, to confirm that any compensating tax that may be due has been paid to the State of New Mexico.- Note: For manufactured homes purchased out-of-state both the Notification of No Tax Liability and the Title Clearance Request are required.

- “Application for Vehicle Title and Registration”

When processing a manufactured home transaction, in addition to all of the usual information entered on the title application, you must also include the size of the manufactured home (width and length). Also include the county in which the manufactured home will be situated and the approximate location where the manufactured home will be located within the county.

“M/HA” Plate Issued

One manufactured home plate is issued for each manufactured home. We no longer issue additional plates for double-wide and triple-wide manufactured homes. The registration is permanent and the manufactured home plate remains affixed to the manufactured home for the life of the unit or until it is sold or transferred to another owner.

Manufactured Homes Taxed as Property

After the initial registration of a manufactured home with the Motor Vehicle Division, the County Assessor in the county where it is located taxes it. Advise the customer(s) to file the manufactured home with the County Assessor.

No Excise Tax

The excise tax is not applicable to manufactured homes purchased from a New Mexico registered dealer.

Instead New Mexico dealers are required to pay a gross receipts tax (GRT) directly to the New Mexico Taxation and Revenue Department on all manufactured home sales transacted in the state. For individual-to-individual transactions, the gross receipts tax is not applicable.

Other Manufactured Home Situations

- In order to obtain a duplicate title or to add or delete a name on a manufactured home title, the “Manufactured Home Tax Status Certification” form (MVD-10063) (or a Tax Certification form provided by the County Treasurer or Assessor) is required.

- Lien Filings Are Assessed $5.00 ($3.00 Transaction fee, $2.00 Administrative fee).

- A manufactured home that came from a “sovereign nation” needs a tax release. The county treasurer will issue a “Mobile Home Tax Status Certification”.

Section D. Deactivation of Title for a Manufactured Home

Revised November 30, 2017

Basic Requirements for Deactivating a Manufactured Home Title (18.19.3.71 NMAC)

Title issued pursuant to the provisions of the Motor Vehicle Code to a manufactured home shall be deactivated by the department when:

A. the person in whose name the manufactured home is titled requests in writing that the department deactivate the title;

B. the title is free and clear of all recorded liens and encumbrances; and

C. the valuation authority certifies to the department that, once title is deactivated, the housing structure will be taxed as real property.

To meet these requirements, MVD will deactivate the title to a New Mexico titled manufactured home once the following requirements have been met.

- The title is free and clear of all recorded liens and encumbrances.

- The “request to change valuation status” (obtained from the County Assessor) has been completed and signed by the County Assessor of the county in which the mobile home is located.

- The title application has been signed by the owner(s) if transaction is a first time title, first time title (out of state), title transfer, lien release/title change, or duplicate title transaction. (Note: If the owner has a title in his possession the title application is not necessary.)

In some circumstances, county assessors have changed a manufactured home’s valuation status to real property even though the title has not been deactivated. The result is a manufactured home that is both real property in the county’s records and a vehicle (personal property) with an active title on MVD’s title records.

MVD will deactivate the title, and issue a new inactive title, if certain conditions are met, as described below.

Deactivation when a Manufactured Home has been Assessed as Real Property

In some circumstances a manufactured home, titled as a vehicle by the MVD, has been placed on a permanent foundation and assessed as real property without the required deactivation of the vehicle title. There may or may not be a recorded lien on the title. There may have been one or more transfers of ownership of the home as real property.

If the current owner wishes to sell or mortgage the home (as real property) a lender, title insurance company, or other party to the transaction may require a hard-copy deactivated title in the name of the current owner before it will proceed.

MVD will now issue a new inactive title to a manufactured home owner, even though the home is currently assessed as real property, as long as there is complete documentation of ownership (or a surety bond); and there are no recorded liens on the manufactured home as a vehicle (personal property).

In this situation, issuance of a new inactive title in the name of the current owner can be processed. The steps that must be followed are:

- Pay the required fees.

- Documentation must include all of the following:

- the county assessor’s statement that the manufactured home is currently assessed as real property;

- a tax release from the county treasurer or assessor;

- a title application signed by the current owner; a lien release for any recorded lien; and

- (if ownership has changed) the complete, fully documented ownership history or a surety bond.

- If there is a recorded lien on the title, but request for release of lien (addressed to lienholder at address of record) is returned undeliverable, we can accept a copy of the request with an undeliverable return receipt.

Note: The title can only be issued if it is deactivated in the same transaction and issued as an inactive title; and there can be no liens on the inactive title.

Section E. Reactivation of Title for a Manufactured Home

Revised November 30, 2017

Requirements for Reactivating a Manufactured Home Title (18.19.3.72 NMAC)

The owner of a housing structure, title to which had been issued pursuant to the Motor Vehicle Code as a manufactured home and which title is deactivated, may request that the title issued pursuant to the Motor Vehicle Code be reactivated. The department shall reactivate the title as a manufactured home pursuant to the provisions of the Motor Vehicle Code and reissue it to the owner only upon receipt of documentation that all liens or mortgages against the housing structure and the land upon which it is affixed have been released. The department shall notify the valuation authority that the title has been reactivated.

To meet these requirements, MVD will reactivate the title to a New Mexico titled manufactured home once the following requirements have been met.

- Proof of ownership

- Proof must describe home by year, make and VIN.

- Proof that no lien or mortgage exists on the home or the land on which it sits – must describe home by year, make and VIN. (A letter from the mortgage company stating that they have interest only in the land on not on the home will suffice.)

- Letter from County Assessor stating that home is assessed as personal property

- Must describe home by year, make and VIN.

- Tax Release from Treasurer or Assessor

MVD will issue a title to the owner for a fee of $5.00.

NEW MEXICO COUNTY CODES

| Code | County | County Seat |

| 01 | SANTA FE | SANTA FE |

| 02 | BERNALILLO | ALBUQUERQUE |

| 03 | EDDY | CARLSBAD |

| 04 | CHAVEZ | ROSWELL |

| 05 | CURRY | CLOVIS |

| 06 | LEA | LOVINGTON |

| 07 | DONA ANA | LAS CRUCES |

| 08 | GRANT | SILVER CITY |

| 09 | COLFAX | RATON |

| 10 | QUAY | TUCUMCARI |

| 11 | ROOSEVELT | PORTALES |

| 12 | SAN MIGUEL | LAS VEGAS |

| 13 | MCKINLEY | GALLUP |

| 14 | VALENCIA | LOS LUNAS |

| 15 | OTERO | ALAMOGORDO |

| 16 | SAN JUAN | AZTEC |

| 17 | RIO ARRIBA | TIERRA AMARILLA |

| 18 | UNION | CLAYTON |

| 19 | LUNA | DEMING |

| 20 | TAOS | TAOS |

| 21 | SIERRA | TRUTH OR CONSEQUENCES |

| 22 | TORRANCE | ESTANCIA |

| 23 | HIDALGO | LORDSBURG |

| 24 | GUADALUPE | SANTA ROSA |

| 25 | SOCORRO | SOCORRO |

| 26 | LINCOLN | CARRIZOZO |

| 27 | DE BACA | FORT SUMNER |

| 28 | CATRON | RESERVE |

| 29 | SANDOVAL | BERNALILLO |

| 30 | MORA | MORA |

| 31 | HARDING | MOSQUERO |

| 32 | LOS ALAMOS | LOS ALAMOS |

| 33 | CIBOLA | GRANTS |

Section F. Used Manufactured Home Never Previously Titled

Revised November 30, 2017

It is an unfortunate fact that many manufactured homes were never properly titled and registered when they were new.

As a result, when the current or new owner seeks to reactivate a used manufactured home’s title so that the home can be moved to a new location, we find that no title exists that we can reactivate.

A title that was never issued cannot be reactivated.

In those circumstances when a customer needs to title a manufactured home for the first time and cannot meet the basic requirements, the customer must provide:

- Proof of ownership

Proof must describe the manufactured home by year, make and VIN. - Proof that no lien or mortgage exists on the manufactured home or on the land on which it sits

Must describe the manufactured home by year, make and VIN.

(A letter from the mortgage company stating that they have interest only in the land and not on the manufactured home will suffice.) - Letter from Assessor stating that the manufactured home is assessed as personal property

Must describe home by year, make and VIN. - Tax Release from Treasurer or Assessor

If complete documentation cannot be produced, a surety bond process may be required.

Section G. Manufactured Home Address Abbreviations

Revised November 30, 2017

When processing a title for a manufactured home, MVD is required to capture the physical location of the home. The field for capturing this information is limited. Therefore you should use the following abbreviations when processing the title.

For physical location fields (not residential address) use:

| Physical Address | Abbreviation |

| County Road | CR |

| House | HSE |

| House Number | #— |

| Private Drive | PD |

| State Road | SR |

| US Highway | HWY # |

| Location | Village, Town or City |

| Forest Service Road | FR# |

| Indian Reservation | Rez |

For mailing address fields use:

| Mailing Address | Abbreviation |

| P.O Box | P.O Box #— |

| Rural Route | RR#– |

| Locations | Village, Town or City |

| Zip Code | Zip #— |

| Cluster Box | CB#– |