Commercial Vehicles (Class 13)

Revised November 30, 2017

All vehicles 26,001 – 80,000 pounds

must be compliant with New Mexico Weight Distance (WD) Taxes and Permits.

All vehicles 55,000 – 80,000 pounds

must provide proof of payment of Heavy Vehicle Use Tax (HVUT).

New Mexico Weight Distance Tax (WDT) Verification (26,001 – 80,000 lbs.)

Tapestry has an interface with GenTax that provides real-time data pertaining to the compliance of Weight Distance Tax and Permits. Tapestry will produce a hard stop if the vehicle in question is not compliant.

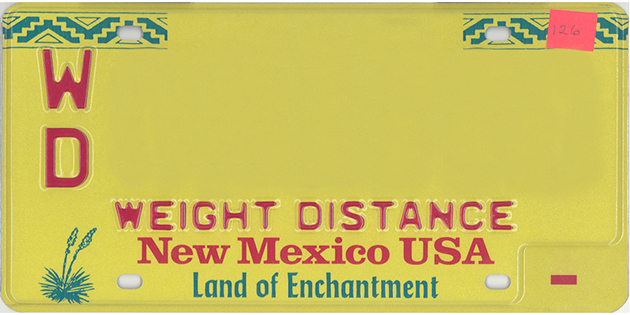

The customer must satisfy the requirements prior to registering the vehicle with a WD plate.

Heavy Vehicle Use Tax (HVUT) Verification (55,000 – 80,000 lbs.)

Federal regulations require that New Mexico receive proof of payment (or proof of tax suspension) of the Heavy Vehicle Use Tax from Motor Carriers as a condition of registration for vehicles that are 55,000 lbs. and over. A copy of the IRS Form 2290 Schedule 1 must be scanned into Tapestry at the time of the transaction. Tapestry will create a work item that will be reviewed by the Commercial Vehicle Bureau for validity. If the work item is denied, the customer has 30 days to provide a valid copy of the 2290 or the WD registration will be suspended.

- Verify that the 2290 Schedule 1 has either a stamp from the IRS or an electronic watermark.

- Verify that the 2290 Schedule 1 is in the name of the individual or company that owns the vehicle.

- Write the WD plate number and indicate which VIN on the 2290 pertains to the transaction.

- Verify that the period on the 2290 Schedule 1 is current.

- Scan the 2290 Schedule 1 into Tapestry.