Section A. Who Must Title and Register a Vehicle in New Mexico?

Section B. Vehicles to be Titled and Registered

Section C. Vehicles Exempt from Title and Registration

Section D. Types of Vehicle Registration

Section E. Temporary Permits

Section F. Out-of-State VIN Inspections

Section G. Odometer Mileage Certification

Section H. Emissions Test Requirements – Bernalillo County

Section I. Credit for Unexpired Portion of Registration Fees

Section A: Who Must Title and Register a Vehicle in New Mexico?

Revised December 1, 2017

General rule

A New Mexico resident who operates a vehicle on the roads and highways of New Mexico must register the vehicle.

However, as described below, certain non-residents must also register their vehicles; and minors cannot be issued a New Mexico vehicle or vessel title and/or registration solely in their own name.

MVD Policy

§66-3-4(A) requires that all applications for vehicle registration and certificate of title shall contain, for a vehicle other than a recreational vehicle, the name, bona fide New Mexico residence address and mail address of the owner or, if the owner is a firm, association or corporation, the name, bona fide New Mexico business address and mail address of the firm, association or corporation and for a recreational vehicle (see Vehicles 15A), the name, bona fide residence address and mail address of the owner and proof of delivery in New Mexico.

For individual owners, we accept as proof of New Mexico residence address either: a) a current New Mexico DL or ID; or b) two documents that would be required to prove residency for a DL or regular ID.

When there are multiple owners, at least one owner must be a bona fide resident of New Mexico. Proof of identity and New Mexico residency is only required for that one owner,

Similar documentation is required of any applicant for vehicle registration and certificate of title that is a firm, association, corporation or other entity (non-individual) owner and is not an established MVD customer. In addition to the specific examples (such as utility bill, insurance bill or bank statement) listed on the chart, acceptable documents to prove New Mexico business address for an entity owner include a business license, articles of incorporation or equivalent documents.

Exception: A nonresident business that owns and regularly operates a vehicle in New Mexico is required to register the vehicle. If the nonresident business has no New Mexico business address we will accept the owner’s out-of-state business address for our records.

New Mexico Residents (§66-3-4)

All applications presented to the division shall contain the name, bona fide New Mexico residence address and mailing address of the owner, or, if the owner is a firm, association or corporation, then the name, bona fide New Mexico business address and mailing address of the firm, association or corporation. Persons without a New Mexico residence address may not title and register their vehicles here. (Exception noted above.)

Nonresidents (§66-3-301)

A nonresident vehicle owner may use or permit the use of the vehicle within the state for a period of one hundred eighty days without registering the vehicle, if the vehicle displays current registration plates issued in the state where the owner resides. However, any person gainfully employed in New Mexico for 30 days or more within a 60-day period shall be presumed to be a New Mexico resident.

The following are not required to register their vehicles if they display current registration plates issued for the vehicle in the state where the owner resides:

- a nonresident student engaged in a full-time course of study at a New Mexico institution of higher learning, if the vehicle displays a valid nonresident student sticker issued by the institution (available at all New Mexico institutions of higher learning.); or

- a nonresident owner gainfully employed within the boundaries of this state who uses his vehicle to commute daily from his home in another state to and from his place of employment within this state, but only if the state in which the owner resides extends like privileges to New Mexico residents gainfully employed within the boundaries of that state.

In addition, by MVD policy, nonresident military assigned to a New Mexico military installation have the option of maintaining current registration in their home state or registering and titling their vehicles in New Mexico.

A nonresident owner of a foreign vehicle operated within this state for the transportation of persons or property for compensation or for the transportation of merchandise either regularly according to a schedule or for a consecutive period exceeding 30 days shall register the vehicle and pay the same fees as would be required of a New Mexico resident.

Every nonresident including any foreign corporation carrying on business within this state and owning and regularly operating in such business any motor vehicles, trailer, semitrailer, house trailer or pole trailer within the state, shall register each such vehicle and pay the required fees.

Minor Applicants

Minors cannot be issued a New Mexico vehicle or vessel title and/or registration solely in their own name. An adult New Mexico resident must also be listed as an owner upon the vehicle or vessel title and/or registration and must accompany the minor during the title/registration process.

However, an emancipated minor may apply for a vehicle or vessel title and/or registration without the presence of an adult. The emancipated minor must present the original or a certified copy of the minor’s marriage certificate or court order of emancipation. CSRs must record on the vehicle or vessel title/registration application the type of supporting document(s) presented.

Clarification:

A Minor is anyone under 18 years of age.

An emancipated minor (NMSA 32A-21-3 to 32A-21-5) is any person 16 years of age or older who has entered into a valid marriage; is on active duty with any of the U.S. armed forces; or has received a declaration of emancipation from the children’s court of the district in which he resides.

In addition:

- A minor may apply for a duplicate title without the presence of an adult.

- The assignment for sale of a vehicle or vessel must include the signature of an adult.

- It does not matter who is listed first upon the title assignment, the minor or the adult.

- Minors may participate in VIN inspection activities without the presence of an adult.

- Minors may re-register a vehicle without the presence of an adult.

Section B: Vehicles to be Titled and Registered

Revised December 1, 2017

Vehicles to be titled and registered (§66-3-1)

With specific exceptions (see ?Section C of this chapter) every motor vehicle,trailer, semitrailer and pole trailer when driven or moved upon a highway and every off-highway motor vehicle is subject to the registration and certificate of title provisions of the Motor Vehicle Code.

Vehicles that must be titled and registered in New Mexico generally include:

- Passenger Vehicles, i.e. motor vehicles designed, used or maintained primarily for the transportation of people (as opposed to trucks that are designed, used or maintained primarily for the transportation of property)

- Trucks

- Motorcycles

- Recreational Vehicles

- Motor Homes

- Off-Highway Motor Vehicles, including (§66-3-1001.1): a) all-terrain vehicles; b) off-highway motorcycles; c) snowmobiles; and d) any other vehicle that is operated or used exclusively off the highways of this state and that is not legally equipped for operation on the highways of this state (e.g. dune buggies)

- Buses

- Manufactured Homes (Mobile Homes)

- Trailers, including a) camping trailers; b) horse trailers; c) utility trailers; d) freight trailers; e) recreational travel trailers; f) fifth-wheel trailers; g) pole trailers; and h) van trailers

Section: C: Vehicles Exempt from Title and Registration

Revised November 17, 2017

The following vehicles are exempt from title and registration requirements:

- U.S. Government and Other States’ Government Vehicles (§66-6-14)Vehicles or trailers owned and used in the service of the United States or any state or political subdivision thereof, other than the State of New Mexico, need not be registered but must display plates or signs showing that they are in the service of the United States or such other state or political subdivision.

- State, Indian Nation, Tribe or Pueblo, and Local Government Vehicles (§66-6-15)Vehicles or trailers owned and used in the service of an Indian nation, tribe or pueblo located wholly or partly in New Mexico, or of any New Mexico county or municipality need not be registered but must display plates furnished by the Motor Vehicle Division.Vehicles or trailers owned and used in the service of the state need not be registered but must continually display plates furnished by furnished by the Transportation Services Division of the General Services Department.

- Vehicles Driven or Moved by Manufacturers, Dealers, or Lien Holders (§66-3-6)Vehicles driven or moved by manufacturers, dealers or lien holders need not be registered when being driven or moved only for the purpose of immediate delivery, demonstration or resale to another person. Such vehicles must display a dealer’s plate or temporary permit.

- Vehicles Owned by Non-Residents (§66-3-301)With some exceptions (see Vehicles 2B), vehicles owned by nonresidents need not be registered, provided that the vehicle is registered in and displays a current license plate from another licensing jurisdiction.

- Vehicles Operated Exclusively on Private Property (§66-3-1(A)(2))Any vehicle, which is driven or moved upon a highway only for the purpose of crossing such highway from one property to another need not be registered.

- Implements of Husbandry (§66-3-1(A)(3))An implement of husbandry (farm equipment), which is only incidentally operated or moved upon a highway, need not be registered.

- Special Mobile Equipment (§66-3-1(A)(4))Vehicles not designed or used primarily for the transportation of persons or property and incidentally operated or moved over the highways, including but not limited to farm tractors, road construction or maintenance machinery, ditch-digging apparatus, well-boring apparatus and concrete mixers need not be registered.

- Electric Trolleys (§66-3-1(A)(5)) A vehicle propelled exclusively by electric power obtained from overhead trolley wires, though not operated on rails, need not be registered.

- Freight and Utility Trailers (§§ 66-3-1(A)(6) and (7))A freight trailer need not be registered if it is properly registered in another state.A freight or utility trailer need not be registered if it is owned and used by: a) a nonresident solely for the transportation of farm products purchased from growers or producers and transported out of the state; b) a farmer or rancher who transports to market only the produce, animals, or fowl produced by the farmer or rancher or who transport supplies back to the farm or ranch ; or c) a person who transports animals to and from fairs, rodeos, or other places, except racetracks, where the animals are exhibited or otherwise take part in performances, in trailers drawn by a motor vehicle or truck of less than 10,000 pounds gross vehicle weight rating bearing a proper registration plate, but in no case shall the owner of an unregistered trailer described in this paragraph perform such uses for hire.

- Mopeds (§66-3-1(A)(8))

- Motorcycle Trailers (MVD policy)

- Tow Dollies (MVD policy)

- Electric personal assistive mobility device (§66-3-1(A)(9))

- Vehicles moved on a highway by a towing service (§66-3-1(A)(10))

- Certain off-highway motor vehicles (§66-3-1(A)(11))An off-highway motor vehicle that is exempted by §66-3-1005 from the provisions of the Off-Highway Motor Vehicle Act need not be registered.

- Vehicles Purchased by a New Mexico DealerA New Mexico dealer is not required to convert a vehicle’s title to the dealer’s name prior to the sale.

- Vehicles Purchased by New Mexico AuctionsThe auctioneer can assign the title to an individual purchaser, provided they are licensed as a dealer, without the need of the auction firm having to apply for title in the firm’s name.

- RepossessionsThe repossessor does not have to convert any type of title into the repossessor’s name prior to a subsequent sale. Titles from all states will be accepted for transfer and registration without the necessity to title in the repossessor’s name.

- Insurance CompaniesInsurance companies do not need to convert any type of title into their name before making a subsequent assignment if the insurance company purchased an insured’s interest in the vehicle as a result of a claim.

Section D: Types of Vehicle Registration

Revised November 17, 2017

- Staggered Vehicle Registration (§66-3-19)All vehicles (except off-highway vehicles, freight trailers, permanently registered utility trailers and travel trailers, and others noted below) are presently registered on a staggered one-year or two-year basis with the registration expiring one or two years from the month in which the title and registration are issued.These vehicles are issued a license plate and validation sticker, which shows both the month and year that the current registration will expire. Registration expires on the last day of the month and year shown on the validation sticker and on the Certificate of Registration.

Off-highway vehicles are issued a staggered three-year registration sticker; the computer system will print the registration certificate with an expiration date of three years.

NOTE: There is no grace period for expired registrations. Persons who operate their vehicles after the expiration date are subject to late registration penalties (§66-3-19(E)). - Fleet Vehicles RegistrationThe fleet vehicle registration program allows the owner of 10 or more vehicles that are under 26,001 pounds to register all of the vehicles in the common month of December. A staggered year/month validation sticker showing the month of December and the current year is issued.NOTE: After October 1, clerk will issue a December staggered sticker for the next year and assess 12 months registration fee plus the additional monthly increments. (Example: October application – charge 14 months registration).

Fleet owners must renew their registrations for their vehicles by December 31 of the current year. Failure to do so will result in late penalty fees.

- Permanent Registration (§66-3-2A)The registration for freight trailers is permanent. Freight trailers will be registered once. At the time of resale, the new owner will be required to pay the registration fee in their own name. The license plate itself will have affixed to it by stamp or impression the word “PERM” and/or “PERMANENT.” The paper registration certificate for that plate and vehicle will reflect the term “permanent” in regards to expiration. Both the vehicle and Certificate of Registration will be permanent for the life of the vehicle.Utility trailers and travel trailers not used in commerce whose gross vehicle weight is under 6,001 lbs. may also be registered permanently. The permanent registration fee for a utility trailer is $25.00 for the first 500 pounds, plus $5.00 for each additional 100 pounds rounded. The fee for a travel trailer is computed by dividing the weight by 2, then assessing $25.00 for the first 500 pounds, plus $5.00 for each additional 100 pounds rounded. The registration fee for transfer of a permanently registered trailer is $5.

- Commercial Vehicle Registration – Vehicles Over 26,000 Pounds DGVWWD Plate (Full Base Plate) – Issued at a MVD Field Office:A vehicle titled in New Mexico with a declared gross vehicle weight that exceeds 26,000 pounds and is involved in commerce is issued a WD plate. This type of registration is generally utilized for intrastate operations of New Mexico based vehicles.

A weight distance permit is required for all WD plated vehicles and the carrier is required to file a quarterly WD tax report.

IRP – Issued at the Commercial Vehicle Bureau:

The International Registration Plan is a program for licensing commercial vehicles (tractors, trucks and buses) in interstate operations among member jurisdictions. A carrier should obtain apportioned registrations for its fleet if the vehicles are titled in New Mexico and if 1) vehicles have two axles and a gross vehicle weight or registered gross vehicle weight in excess of 26,000 pounds; 2) a power unit having three or more axles, regardless of weight; or 3) a vehicle used in combination with a trailer and the weight of such combination exceeds 26,000 pounds gross vehicle weight.

Optional: Trucks or truck tractors, or combinations of vehicles having a gross vehicle weight of 26,000 pounds (11,793.401 kilograms), or less.

IFTA:

The International Fuel Tax Agreement is a base state fuel tax agreement. Upon application, the carrier’s base state jurisdiction will issue credentials (both a license and decals) which will allow the IFTA licensee to travel in all IFTA member jurisdictions. Any carrier having IFTA is required to file a quarterly tax report.

Section E:Temporary Permits

Revised November 17, 2017

The Motor Vehicle Division issues six types of temporary registration permits that allow for the temporary operation of a vehicle on New Mexico streets and highways under certain conditions.

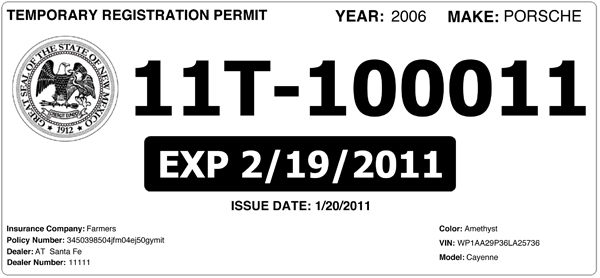

- Retail Permit (§66-3-6(A)) (up to 30 business days)The department may issue a temporary registration permit to individuals to operate a vehicle pending action by the department upon an application for registration and Certificate of Title or renewal of registration when the application is accompanied by the proper fees and taxes. The temporary registration permit shall be valid for a period not to exceed 30 business days from the day it is validated by the department. Temporary registration permits shall not be extended nor shall another be issued except for good cause shown.

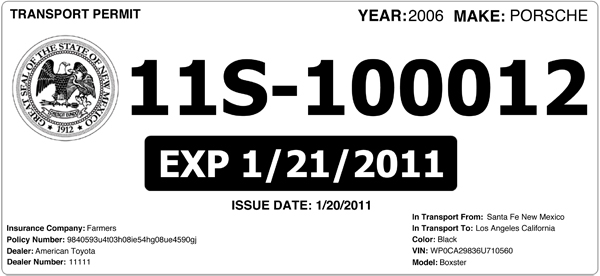

- Transportation Permit (§66-3-6(C)) (up to 10 business days)

The department may issue a transport permit to a manufacturer of vehicles for the purpose of demonstrating or transporting the vehicle to a dealer’s location. The transport permit shall be valid for a period not to exceed 10 business days, shall state the number of days for which the transport permit is valid and shall be validated by the signature of the manufacturer or transporter. Transport permits shall not be extended nor shall another be issued except for good cause shown.

- Out-of-State Transportation Permit (§66-3-6(C)) (2-10 business days?)

A 2-10 day transportation permit may be issued to out-of-state residents who purchase a vehicle in New Mexico and will be titling in their state of residence. Applicant must provide proof of Insurance.

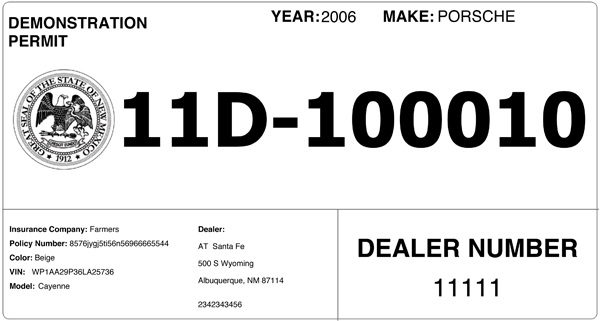

- Demonstration Permit (§66-3-6(F)) (as long as vehicle is held in dealer’s inventory)

The department shall issue demonstration permits to dealers licensed pursuant to §66-4-1. Demonstration permits shall be used only on vehicles included in the inventory of the dealer to whom the demonstration permits are issued. The demonstration permits shall be used to allow the operation of vehicles for the limited purposes of testing, demonstrating or preparing a vehicle for sale or lease.

Demonstration permits may not be used on work or service vehicles that are owned, used or held in inventory by a dealer. A demonstration permit, after being affixed to a specific vehicle, shall be valid for as long as the vehicle is held in the dealer’s inventory. A dealer who uses demonstration permits is required to maintain a list showing the date on which the dealer assigned the permit to a vehicle and the name and a description of the vehicle, including its make, model, model year and vehicle identification number.

A dealer shall maintain the list for three years from the end of the year in which the dealer issued the permit and must make it available to TRD-MVD and to law enforcement officers during reasonable business hours. When a vehicle is sold, the dealer shall keep demonstration permits with other records of the sale. A demonstration permit shall name the dealer to whom the demonstration permit is issued and display a unique identification number assigned by the department.

- Temporary Authorization to Operate Pending Receipt of Title from Lien HolderThe Request for Lien Holder Title form (MVD-10234 rev. 8/94) is used when an individual moving to New Mexico from out of state seeks to title a vehicle, but does not have the title in his possession because it is being held by a lien holder. The system generates the request that is sent to the lienholder with a copy for the customer. The customer copy is a 30-day temporary permit to operate the vehicle while we wait for the title to be sent to us.

- Temporary Commercial Vehicle PermitsOnly the Commercial Vehicle Bureau in Santa Fe can issue commercial vehicle permits.

Note:

Oversize vehicle permits (e.g. manufactured homes) are issued by the Motor Transportation Department (MTD), not by MVD. The MTD can be contacted at (505-827-0376).

Section F: Out-of-State VIN Inspections

Out-Of-State VIN Inspections Accepted Under Limited Circumstances

Out-Of-State VIN Inspections will be accepted under limited circumstance for New Mexico residents (Service members, college students, etc.) to obtain a New Mexico title and registration.

Out-Of-State Inspections Using Other State’s Form

Inspections done outside of New Mexico for New Mexico residents should be done on the other state’s official form and include verification of two identity points on the vehicle.

Alternative Customized Affidavit of VIN

In the event that the other state does not have an official VIN Inspection form, or that state’s form is not acceptable (example: does not have two identity points), a customized Affidavit of VIN form should be requested from the Bureau Chief to be sent to Law Enforcement. We can send our VIN Form to Law Enforcement ONLY. The form will be valid only for the specific vehicle requested. Please ask your manager for the instructions for coordinating this with your Bureau Chief.

VIN Inspector Must Be Certified (MVD/DMV Agent from that state or Law Enforcement Officer)

The VIN inspection must be performed by a certified VIN inspector or law enforcement officer from the state where the inspection was performed and must have the Inspector or Officer’s original signature, the law enforcement agency the officer is employed by, badge number (if applicable) and, if possible, copy of credentials.

Out-of-State VIN inspections are valid for 90 days from date of inspection.

KEY POINTS:

- List where they found the primary and secondary identity points on the vehicle.

- Only 1 VIN/HIN needed for boats, trailers, travel trailers

- VIN form or affidavit of VIN needs to be completed by a certified VIN inspector

- Out-of-state VINs can be completed electronically so long as the certifying signature is pen-to-paper. (Only exception to the pen-to-paper requirement is for HIN inspections completed by a Certified Marine Surveyor with the embossed stamp.)

- We need the original inspection unless completed by law enforcement. Law enforcement can email it to the MVD Bureau Chief directly. Please follow Appendix 1 for the instructions for coordinating.

HIN inspections completed by a certified Marine Surveyor with the embossed stamp is acceptable inspection for boats.

Section G: Odometer Mileage Certification

Odometer Mileage Certification

Revised November 17, 2017

Odometer Mileage Definitions

- AM (actual mileage)

the actual mileage of the vehicle - EL (excess of limits)

the vehicle’s mileage in excess of mechanical limits – relates to vehicles that have 5- or 6-digit analog or digital odometers that can record up to 99,999 or 999,999 miles - NM (not the actual mileage)

used when the odometer is not working or the original (MCO) vehicle engine has been replaced or rebuilt - EX (exempt)

can be used when a vehicle is 10 years or older - Analog odometer

a wheel-type odometer, with a mechanism that spins to record mileage - Digital odometer

an electronic display of recorded mileage

Actual Mileage or Not Actual Mileage

Whoever has the legal ability to transfer title also has the ability to assert actual mileage (“to the best of my knowledge”), except when there is a gap in the vehicle’s ownership history such that the transferor cannot reasonably claim to have knowledge of the vehicle’s actual mileage.

For example:

- The personal representative of a vehicle owner who is deceased or otherwise incapacitated and unable to sign for himself may assert actual mileage (AM).

- However, when an abandoned vehicle is towed and title is subsequently acquired by the towing company using the towing lien process, the new owner cannot claim to know the vehicle’s actual mileage, and mileage must be recorded as NM (not actual mileage).

Do not use 888888

888888 (and other non-accurate numbers) may no longer be used as an odometer reading for EL and NM odometer codes. The certified odometer reading will be the mileage with AM, EL, NM or EX as the mileage code.

- A five-digit analog odometer reading 24357 will be recorded 24357 with either the EL or NM mileage code. EL would show that the vehicle has gone over 99,999 miles. There may be exceptions for show-type vehicles with documentation.

- A six-digit analog odometer can record up to 999,999 miles. The options would be either AM, EL, NM or EX.

- Digital odometers require vehicle electrical power to verify odometer reading. These odometers are six-digit and can record up to 999,999 miles, so the options are AM, EL, NM or EX.

- If a digital odometer cannot display the mileage it will be recorded as blank (do not enter zeroes), with the NM or EX code.

- When an Odometer Disclosure Statement (MVD-10187) is used with a transfer of a New Mexico title, the actual reading will be used with odometer codes AM, EL or NM. If the title of record shows 888888 as the odometer reading with NM or EL, the new processed title should be recorded with the mileage on the odometer if available, or left blank (do not enter zeroes) if not available, and the appropriate NM, EL or EX code.

- An out-of-state vehicle may have “exempt” or similar description recorded as the odometer mileage. In this case record the New Mexico processed title as recorded on the Affidavit of VIN with the code “NM.”

Use “EX” or “NM” if Previous Title Shows “Exempt” or “888888”

ALWAYS assign the code “EX” to a title if the previous title indicates “Exempt” or “NM” if the previous title, or any transfer on the previous title, indicates “888888.”

- If the previous title is New Mexico (and a VIN Inspection is not required), leave the mileage blank (do not enter zeroes) and enter “EX” or “NM.”

- If the previous title is an out-of-state title (a VIN Inspection is required), use the numerical mileage from the VIN Inspection report and the “NM” code.

Use “EL” if Five-Digit Analog Odometer Statement Shows “EL”

Assign the code “EL” to the title if the vehicle has a five-digit analog odometer and the odometer statement reflects “EL.”

Section H: Emissions Test Requirements – Bernalillo County

Revised November 17, 2017

The information below has been provided by the Albuquerque/Bernalillo County Vehicle Pollution Management Division (VPMD).

Additional information about the Albuquerque/Bernalillo County emissions testing program can be found online at www.cabq.gov/aircare or by email at vpm@cabq.gov or by phone at (505) 764-1110.

Emissions testing is required of motor vehicles registered in or commuting to Bernalillo County.

All vehicles less than 35 years old, up to 10,000 lbs. GVW must pass an emission test every two years and at change of ownership. Diesel and gas-electric hybrid vehicles are required to be tested every two years as well and can be tested at any certified Air Care Station. Only dedicated electric vehicles are exempt from emission testing.

- Vehicles less than 35 years of age, up to 10,000 lbs. GVWR must be tested every two years.

- Change of Ownership

A valid test certificate is required for registration. Vehicles tested within the past 90 days may receive a free retest at 1500 Broadway NE. - Commuter Vehicles

Vehicles entering Albuquerque/Bernalillo County on 60 or more days per year require a test. - Failed Test

The inspection form will indicate the reasons for failure. Documented repair costs or estimates of $300 or more may be eligible for a time extension. - Free Retests

Free retests are available following vehicle repair at 1500 Broadway NE from 8:00 to 4:30 Monday thru Friday. - Time extensions

Time extensions for repair are not automatic. They are limited to one per vehicle for repairs exceeding $300. The vehicle, failed test, and repair receipts or estimate must be taken to the headquarters station to apply for a time extension.

Vehicle Pollution Management Division

Headquarters Retest Facility

1500 Broadway NE

Albuquerque, New Mexico 87102

The Headquarters Retest Facility is located north of Mountain Road, just south of the traffic light at Broadway and Odelia.?

Exempt Vehicle (20.11.100.2(B) NMAC)

- all new motor vehicles for four years following initial registration from the date of the manufacturer’s certificate of origin (MCO);

- vehicles that are fueled by a mixture of gasoline and oil for purposes of lubrication;

- motor vehicles that are used for legally sanctioned competition and not operated on public streets and highways;

- implements of husbandry, or road machinery not regularly operated on public streets and highways;

- other vehicles that are not regularly operated on public streets and highways after providing satisfactory proof to the program manager;

- vehicles leased by a leasing company whose place of business is Bernalillo county to a person who resides outside of Bernalillo county;

- vehicles that are 35 years old or older;

- vehicles sold between licensed dealers;

- vehicles with a GVW of 10,001 lbs or more;

- dedicated electric vehicles; and

- existing electric hybrid vehicles which were exempted from 20.11.100 NMAC as of the effective date of 20.11.100.2 NMAC, until such time that a change of ownership of the vehicle occurs.

Web: http.//www.cabq.gov/aircare

Phone: (505) 764-1110

NOTE: MVD will NOT require proof of physical residence prior to updating address information to registration records.

Emission Inspection

Bernalillo County residents (who fall in the zip code category listed below) will be required to provide emission inspection certificates upon Application for Title and Registration on new and used vehicles. Alternatively, New Mexico Motor Vehicle Division will interface with Vehicle Pollution Management Division, in real-time, to receive Emissions Inspections results electronically.

The following are Bernalillo County zip codes for which emission inspections are mandatory for registering vehicles in the state of New Mexico: 87008 87101 87105 87109 87113 87117 87121 87153 87185 87194 87022 87102 87106 87110 87114 87118 87122 87154 87190 87195 87047 87103 87107 87111 87115 87119 87123 87176 87191 87196 87059 87104 87108 87112 87116 87120 87125 87184 87192 87197 87198

New Mexico Motor Vehicle Division will interface with Vehicle Pollution Management Division, in real-time, to receive Emissions Inspections results information electronically.

Section I: Credit for Unexpired Portion of Registration Fees

Revised December 12, 2017

Credit for Unexpired Portion of Registration Fees (§§ 66-3-20.1(C) and 66-6-22(D))

If the owner of a vehicle that is registered for two years sells, transfers or assigns title to or interest in the vehicle within the first year of registration and applies to have the registration number assigned to another vehicle pursuant to §66-3-101, upon assignment, the person may apply for a refund of one-half of the two-year registration fee.

Any refund may, at the discretion of the department, be made in the form of a credit against future payments due under the Motor Vehicle Code or the Motor Transportation Act if future liabilities in an amount at least equal to the credit amount reasonably may be expected to become due.

Refund of unused second year vehicle registration fee no longer available

Prior to the implementation of Tapestry, customers who had purchased a two-year registration were eligible for a refund of the second year fees paid if the vehicle ownership was transferred within the first year of the two-year registration period.

With the implementation of Tapestry, MVD has been able to program the system to create an automatic credit instead of a refund.

Second-year registration fee refund replaced by automatic credit

If the customer meets the statutory requirements (including that the vehicle owner will transfer the plate to the new vehicle that is the same class as the original vehicle), a credit will now be automatically created in the customer’s vehicle account.

Sample situations:

Credit applies:

- Customer owns vehicle A (class 10) and plate 789xyz is registered to it

- Customer trades in vehicle A (class 10) and purchases vehicle B (class 10)

- Customer asks to register vehicle B using plate 789xyz

Credit does not apply (vehicle class does not match):

- Customer owns vehicle A (class 10) and plate 789xyz is registered to it

- Customer trades in vehicle A (class 10) and purchases vehicle B (class 11)

- Customer asks to register vehicle B using plate 789xyz

NOTE: although the credit does not apply, the customer can use the same plate

Credit does not apply (customer requests/needs new plate):

- Customer owns vehicle A (class 10) and plate 789xyz is registered to it

- Customer trades in vehicle A (class 10) and purchases vehicle B (class 10)

- Customer asks to register vehicle B using a new plate